How to Choose a Good Debt Collection Agency

Hi, my name is Adam Stewart, Debt Collection Expert and owner of Debt Recoveries Australia.

Are you not happy with your current debt collection agent? Are you thinking of changing your debt collection agent? Have you never outsourced your accounts receivable but always wanted to?

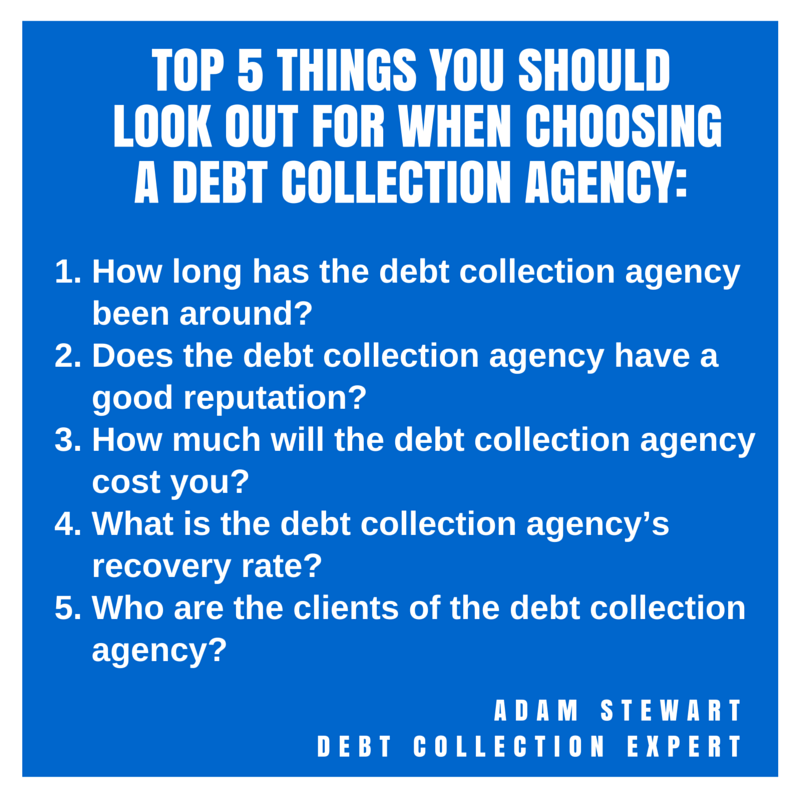

Here are the top 5 things you should look out for when choosing a debt collection agency:

1. How long has the debt collection agency been around?

This may seem obvious, but an agency that has been around a while will have more experience. Check their website or ask them what their experience is, particularly if you have very specific debts that they need to handle. Make sure they have the experience in handling your specific needs before doing business with them.

2. Does the debt collection agency have a good reputation?

No company wants to be involved in shady collections practices, so check the agency’s credibility through their testimonials page, if they have one. Be wary if they do not have any information about their history or their structure on their website. Look for agencies where you can plainly see who is in charge and who will be looking after your work. Be wary of faceless agency websites that may over promise and under deliver.

Here in Australia, ask them if they are members of the Institute of Mercantile Agents. www.imal.com.au . Membership is not compulsory for debt collection agents, but it is a red flag if they are not a member. You can also go to the www.imal.com.au website to find a collection agency you want to work with.

3. How much will the debt collection agency cost you?

Be sure to balance the commission charged with the agency’s success rate. Carefully consider and evaluate how an agency will reduce your costs while improving efficiency. Look for hidden costs. Ask your agency for a sample invoice and sample reports. Ask them for a copy of their service legal agreement.

4. What is the debt collection agency’s recovery rate?

Understand the collection company’s recovery percentages and rates.Remember that the commission rate by itself is meaningless – net return is the key. Ask them what their recovery rate is in your field of work.

5. Who are the clients of the debt collection agency?

Check references, particularly from clients that are in a similar business. Ask the agency to provide you with a list of current clients. Call these clients and ask their opinion on the agency’s debt collection services, if they have had any problems and what their typical success rate is. Check if the agency has a testimonials page. Google their name to see if there are any comments or reviews about their services.

Hopefully, this will help you choose your perfect debt collection agency. I hope you also include me in your choice! Here is a link to your Debt Recovery Expert, Adam Stewart : https://debtrecoveries.com.au/team/adam-stewart-managing-director/

Debt Recoveries Australia is the expert at recovering your outstanding debts without the drama. For more information, email us at email@debtrecoveries.com.au or call 1300 799 511. Tell us your problems on Skype at “debtrecoveries”.

Debt Recoveries Australia

Debt Recoveries Australia

Thanks for the helpful article for choosing a new debt collection agency. I’m looking into hiring a new one and so I’ll be using advice like reputation, recovery rate, and looking at their clients. Thanks for the post.

Pingback: How to Evaluate your Debt Collection Agency - Debt Recoveries Australia

I really like your point about making sure that the debt collection agency has a good reputation. It would be nice to know that others have used them before and had a good reputation. Plus, you might be able to talk to one of their past clients and see how they worked.

Thanks Frank. Yes, I like to provide a list of a few current clients, for potential clients to contact, so that they can ask questions about success rate, service levels etc. It’s a great idea. Testimonials pages are good to look for.

Pingback: How to Write Your Own Debt Collection Letter Better - Debt Recoveries Australia

When we buy life insurance, we must continue to review or we must know how clear the insurance system. An insurance company definitely has a collection of debts, and uses debt collection to remind their forgetting clients to pay for insurance. we must continue to review or we must know how clear the insurance system. Insurance is important to us. credifin-nederland.nl